Mileage Receipt

Statewide Travel Policy Changes effective Feb. Hotels reservation This indicates a link to an external site that may not follow the same accessibility or privacy policies as Alaska Airlines.

For more information on mileage accrual and Premier benefits on Eurowings-operated flights please see the Eurowings airline partner page.

. Take a picture of the receipt. You sync your credit cards and bank accounts to track expenses. Renting car seats GPS or additional equipment.

MAKE A MILEAGE LOG. Click the Set up mileage claims. If youre requesting missing miles from a Delta flight enter your SkyMiles number and ticket number found on your boarding pass or on your ticket receipt to submit the request.

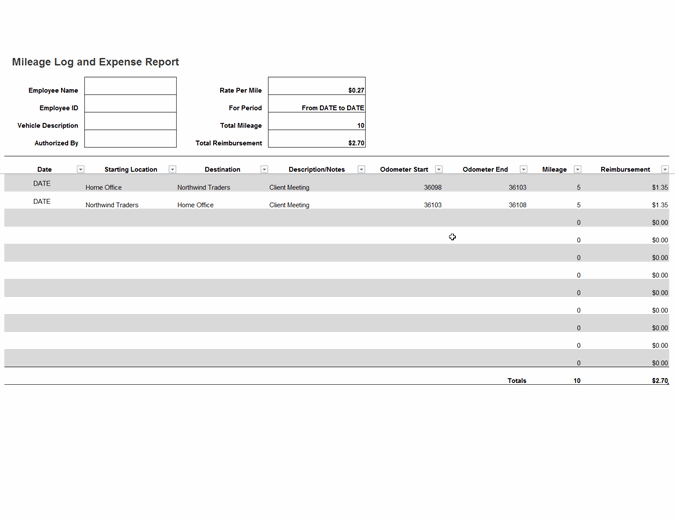

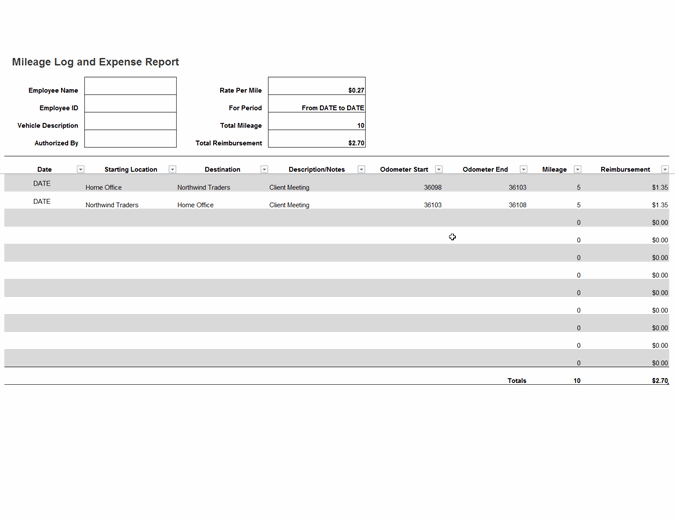

Use this mileage reporting form to keep track of your destinations traveled miles driven and total amount. Review the uploaded information and confirm its correct. RECEIPTS FOR MAJOR BRANDS.

Automatic transaction logs. Submit your pickup and drop-off locations dates and times into the reservation form aboveThen click Select My Car. Once done all employees who already have access to Xero Expenses can add a mileage claim.

Mileage must be recertified every two years to continue to received the waiver. The app wants to cut out all the hassle in accounting and ensure your books are kept up-to. Make this your easiest tax year ever Get an IRS-ready report with everything you need to file.

Turn your shoebox of receipts into tax savings Save photos of your receipts to make tracking expenses a breeze. Is Georgia State Sales Tax exempt for my hotel stay. Mileage log and expense report.

Everlance automatically logs tax-deductible business mileage expenses receipts more. Vehicles registered as a Class N street rod vehicle. On average people find over 5600 in tax deductions.

For calculating the mileage difference between airports please visit the US. Extracted data is fully searchable and editable. It helps streamline your record-keeping process by.

Adams ABFAFR12 Vehicle Mileage and Expense Journal 5-14 x 8-12 Fits the Glove Box Spiral Bound 588 Mileage Entries 6 Receipt PocketsWhite. Vehicles registered as a Class H school vehicle or Class P passenger bus infoMVA Home Vehicle. Tools and Forms Hotel Motel Tax Exemption Form.

Just snap a picture of the receipt and the app extracts all the information from it. Mileage Reimbursement Rates Policy. For Companies For Self-Employed.

If you are the primary cardholder on the account have entered your Mileage Plan number into your reservation and are traveling on Alaska Airlines we will automatically waive the first checked bag fee for you and up to 6 other guests on the same reservation. Shoeboxed lets you track receipts mileage and even business cards without needing any manual data-entry operations. A military vehicle owned by the federal government and used for tactical combat or relief operations or for training for these operations.

Click the settings icon then select the Mileage claims tab. Select the accounts you want your team to use when creating expense claims then click Use number account for expense claims. OPB - Payment and Accounting for Advances Policy Mileage Mileage Rate Update 2022.

Everlance - Best for Reimbursement and Mileage. Policy Statewide Travel Policy. Department of Transportations Inter-Airport Distance.

If you are flying to or from Berlin TXL Cologne CGN Dusseldorf DUS London LHR or Stuttgart STR Eurowings may be the operating airline of your flight. We extract the most important data points on your receipts and automatically categorize them by vendor total spent date and payment type. Standard mileage rates for moving purposes.

Discover new write-offs found by our tax experts. Record the mileage for each stateprovince individually on a spreadsheet as youll need to add all miles traveled for a particular state across all your trips. Repeat until youve done this for all trips.

Report your mileage used for business with this accessible mileage log and reimbursement form template. Airplane nautical miles NMs should be converted into statute miles SMs or regular miles when submitting a voucher using the formula 1 NM equals 115077945 SMs. This app enables you to track mileage expenses and receipts.

Custom Large Logo Receipt. The app introduced in 2015 allows for easy categorizing. The mileage calculator you use should then present you with a route as well as the miles traveled in each stateprovince.

The app will scan the receipt and add it to your Uploads page. UBER Style Taxi Receipt. How Can the Digital Bills and Receipt Scanner Help My Business.

View hotel car and ride reservations. Adams Bookkeeping Record Book Monthly Format White AFR71 85 x 11 inches. The receipt will be added as an expense in your account.

Fixed Variable Rate reimbursement design management. Get a Receipt Moving Truck or. Cars reservation This indicates a link to an external site that may not follow the same accessibility or privacy policies as Alaska Airlines.

Receipts can be. Our team of tax. Quick Recap - Trip Mileage Calculator.

Deposit required upon pickup. By selecting a partner link you agree to share your data with these sites. Shoeboxed made the cut in our list of best expense tracking apps because it offers receipt digitization and organization.

RESERVATIONS RESERVATIONS Start a Reservation ViewModifyCancel Get a Receipt Start a Moving Truck or Van Reservation Short Term Car Rental Subscribe with. Receipt scanning Expensify is an automated business app that aims to manage your expenses in real-time. The free checked bag benefit will be awarded to the designated Mileage Plan membership account one 1 for.

MileagePlus members can earn award miles and Premier. Choose your car and select Pay Now or Pay Later payment. Hurdlr automatically tracks all of your mileage expenses income streams and tax deductions in real-time.

Quickly overcome obstacles to year-round accounting bookkeeping and income taxes. This is the placeThe mileage details of your car will be found in the top right corner of the page. Effortless mileage tracking Automatically track your miles any time youre driving for work.

A popular app among the self-employed Everlance provides solutions for how to keep track of business expenses. Automatic Business Expense Mileage Tracker. Auto Mileage Expense Notebook Vehicle Mileage Log Miles Log Book to Track Over 400 Rides or Sessions Track Odometer for Business Driving.

We would like to show you a description here but the site wont allow us. Our team members double check extracted information so you know youre seeing human verified data you can trust. Make Brand Named Receipts.

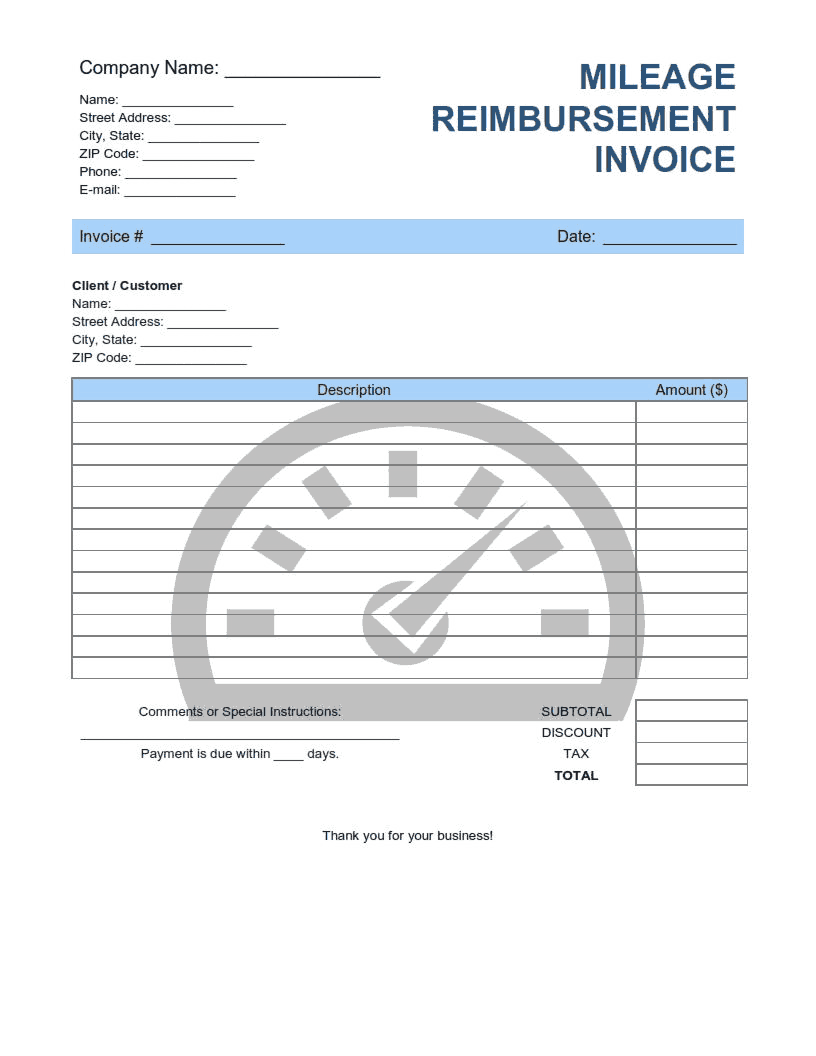

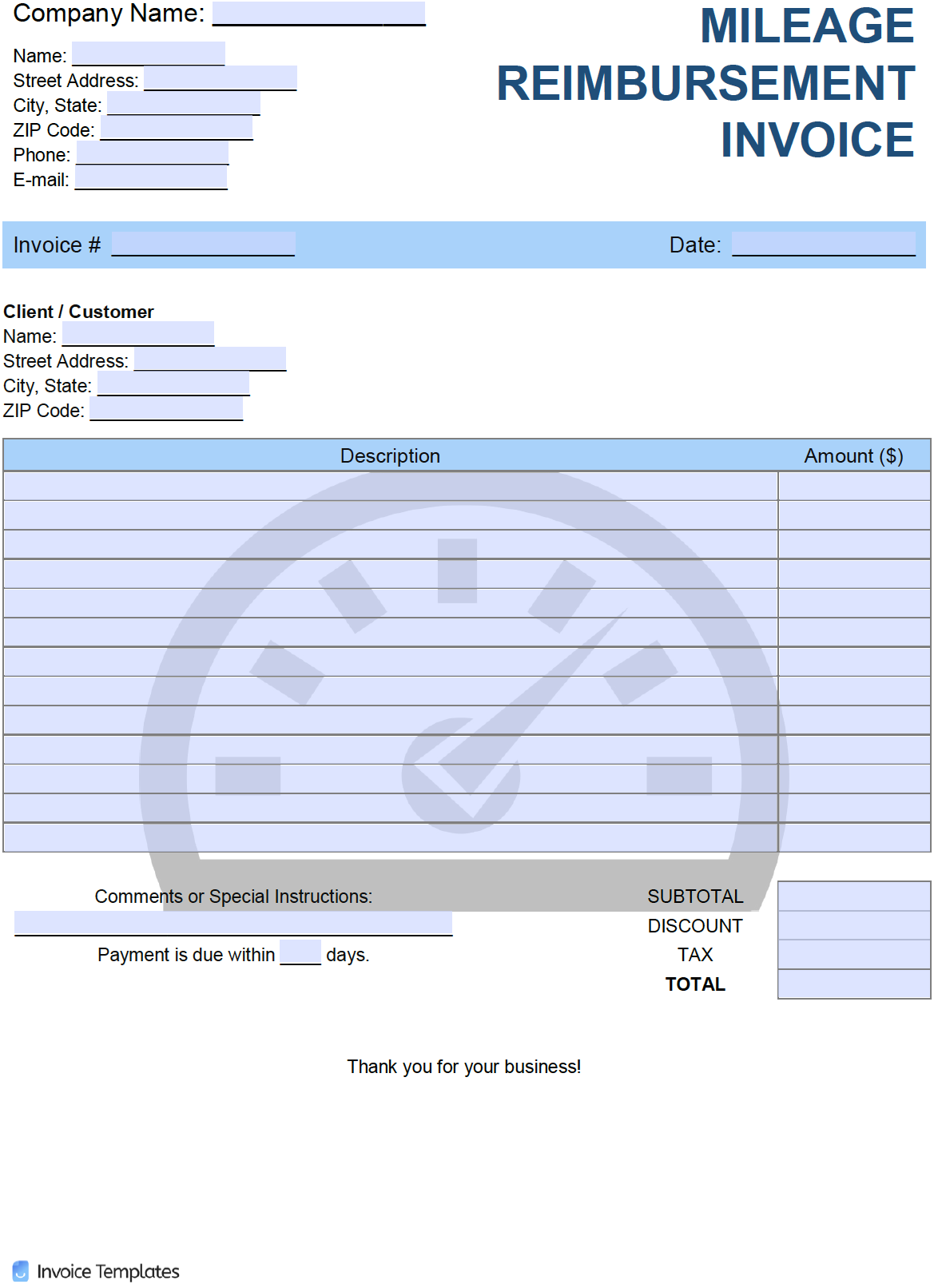

This mileage reimbursement form template calculates amounts for you to submit as an expense report. GET THE APP GET STARTED Learn about Enterprise Solutions. Mileage Rate History Document.

Insurance and protection product options.

Mileage Reimbursement Invoice Template

Mileage Reimbursement Form Template Mileage Reimbursement Mileage Log Printable Mileage Printable

Mileage Log And Expense Report

Mileage Reimbursement Invoice Template Word Excel Pdf Free Download Free Pdf Books

Free Mileage Reimbursement Invoice Template Pdf Word Excel

How To Record Mileage Help Center

Comments

Post a Comment